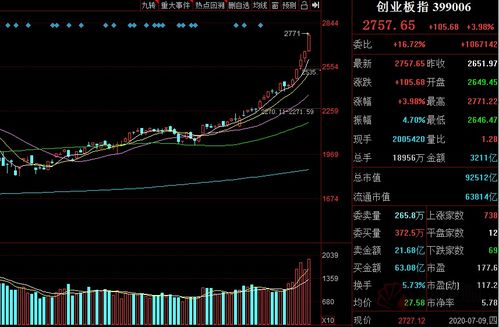

创业板全部股票名单

Title: Exploring China's ChiNext Stock Market: Opportunities and Considerations

Exploring China's ChiNext Stock Market: Opportunities and Considerations

China's ChiNext, established in 2009, is a NASDAQstyle growth enterprise board, aimed at fostering the growth of innovative, highgrowth companies. With its focus on technology, innovation, and emerging industries, ChiNext has attracted significant attention from both domestic and international investors.

ChiNext, officially known as the Shenzhen Stock Exchange ChiNext Market, is a platform for small and mediumsized enterprises (SMEs) to raise capital through the public equity market. It is part of the Shenzhen Stock Exchange (SZSE) and operates independently from the main board.

Key features of ChiNext include:

- Focus on Innovation: ChiNext primarily targets companies in hightech and emerging sectors, including biotechnology, new energy, information technology, and advanced manufacturing.

- Listing Requirements: While ChiNext offers a streamlined listing process compared to the main board, companies still need to meet certain criteria regarding profitability, market value, and corporate governance.

- Market Dynamics: ChiNext is known for its high volatility and speculative nature, attracting both riskseeking investors and those looking for highgrowth opportunities.

Investing in ChiNext offers several potential advantages:

- Growth Potential: Companies listed on ChiNext are often in their early stages of development, with significant growth potential if they successfully execute their business strategies.

- Access to Emerging Industries: ChiNext provides exposure to sectors driving China's future economy, such as artificial intelligence, renewable energy, and electric vehicles.

- Diversification: Including ChiNext stocks in a portfolio can enhance diversification, particularly for investors heavily concentrated in traditional industries.

Despite the opportunities, investing in ChiNext comes with its own set of considerations:

- Volatility: ChiNext is known for its volatility, with prices often subject to rapid fluctuations based on market sentiment and speculation.

- Risk: Many ChiNext companies are highrisk, highreward ventures, with a higher likelihood of failure compared to established firms.

- Regulatory Environment: Changes in government policies and regulations can impact ChiNext companies, particularly in industries sensitive to government intervention.

- Information Asymmetry: Due diligence is crucial when investing in ChiNext, as information transparency and corporate governance standards may vary widely among listed companies.

For investors considering ChiNext, it's essential to:

- Conduct Thorough Research: Before investing, thoroughly research potential ChiNext companies, including their business models, competitive advantages, and management teams.

- Assess Risk Tolerance: Understand and assess your risk tolerance, as investing in ChiNext entails higher volatility and risk compared to more established markets.

- Diversify Portfolio: Include ChiNext stocks as part of a diversified portfolio to mitigate risk and capture potential growth opportunities across different sectors.

- Stay Informed: Stay abreast of market developments, regulatory changes, and company updates to make informed investment decisions.

While investing in ChiNext can offer opportunities for high returns, it's crucial for investors to approach it with caution, conduct thorough due diligence, and carefully assess their riskreturn profiles.

Remember, investing always carries inherent risks, and seeking guidance from financial professionals is advisable, especially when venturing into volatile markets like ChiNext.